Nick Pirsos, Wealth Advisor at MRA Advisory Group, published his updated view of equity markets. You are invited to schedule a complimentary first meeting (via the link below) to discuss his views in greater detail and to learn how to best optimize your portfolio to better attain your retirement goals.

Capital markets continue to baffle near-term investor attitudes driven by a dizzying array of evolving global factors including; China opening possibility, Covid restrictions re-emergence, Crypto crash, CPI and Commodities trends, Congressional (US) election results, and Currency fluctuations.

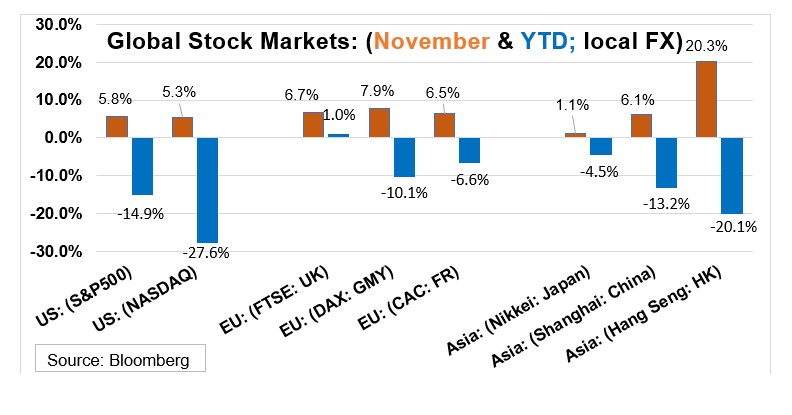

In November, most developed country stock markets were up between 5%-8%. Asian markets were the outliers with Hong Kong benefiting from hoped-for China Covid relaxations but Japan suffering from its steepest manufacturing contraction. Despite November’s generally strong gains, which added to October’s outperformance, YTD most global stock markets remain in negative territory.

The varied gyrating macro global factors, which have affected investor confidence and valuation levels, can best be detected by the above-average volatility of the VIX index, which has experienced one of its busiest annual seasons recording five approximate 50% moves in 2022.

Should Investors Take Profits? If recent history is to repeat, the near-term equity trading call per the VIX is to the downside. But should it be? We took the contrarian view at the end of September with our long equity trading call, which benefitted our clients as the S&P 500 gained 9.7%. We believe this technical-based rally can continue given Federal Reserve Chairman Powell’s comments that the pace of interest rate increases could be slowing starting in December, coupled with the approximate 5% weakening of the USD in recent weeks.

2023 Outlook

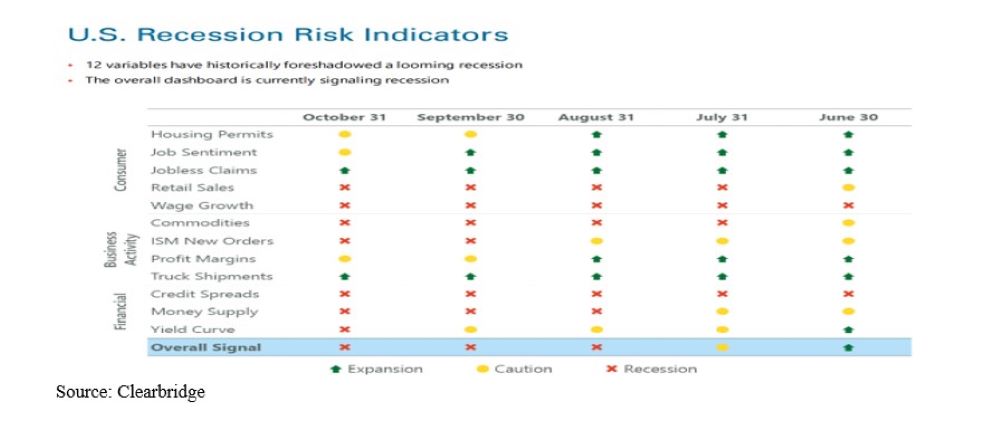

We will publish next month our expected view of the economy and the stock market for next year. In the interim, we can see that fundamental operating conditions in the US continue to ease.

ACTION PLAN:

Have you aligned your portfolios with your 2023 Investment Objectives? If not, we can help.

Unsure how to deploy your year-end IRA RMD funds? We can help.

We can also assist with:

- Strategies to mitigate monthly equity volatility.

- Identifying your portfolio’s current expected risk/opportunity level.

- Building consistent monthly investment income.

- Capital gains tax optimization.

- Or any other personal Financial Planning and Retirement Savings needs including College Planning/529 Plans, Insurance (Life, Disability, Group Health), Wills, and Estate Planning.

- Small Business owners, we can help improve employee retention by creating low-cost 401K plans, Pension Plans, and Group Medical Health Insurance programs.

Feel free to share our views with family or friends who are also confronted with these important Wealth Planning decisions. MRA Advisory Group and I are ready to discuss all your investment concerns to best position your Retirement Goals.

We offer a broad spectrum of affordable, custom-tailored, subscription services.

Your answers and solutions are one click away! To get started, click the “Let’s Talk” button below!

Advisory Services are offered through MRA Advisory Group, a Registered Investment Adviser. This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. The investments and strategies mentioned may not be suitable for all investors. Past performance is no guarantee of future results. Nothing herein, nor any attachment, shall be considered to constitute (i) an offer to sell, nor a solicitation of an offer to purchase, any security, or (ii) tax or legal advice.